Real estate always comes with opinions. The market, thankfully, comes with evidence.

Strip away the forecasts and hot takes, and a clearer picture emerges of what actually happened in Oregon and Southwest Washington last year. Start with the closings.

Advisors at Cascade Hasson Sotheby’s International Realty completed approximately 3,469 transactions in 2025, representing $3.25 billion in sales. Impressive, yes. But the real value of that scale is perspective. At volume, the market stops being theory. It becomes pattern recognition. Momentum becomes visible. So does hesitation.

That perspective helps explain why the firm is on track to be ranked the No. 1 brokerage in Oregon by sales volume again when RealTrends releases its 2025 rankings later this year, marking what would be a third consecutive year at the top.

⸻

Where the Market Really Lived

Luxury gets attention. It rarely carries the market.

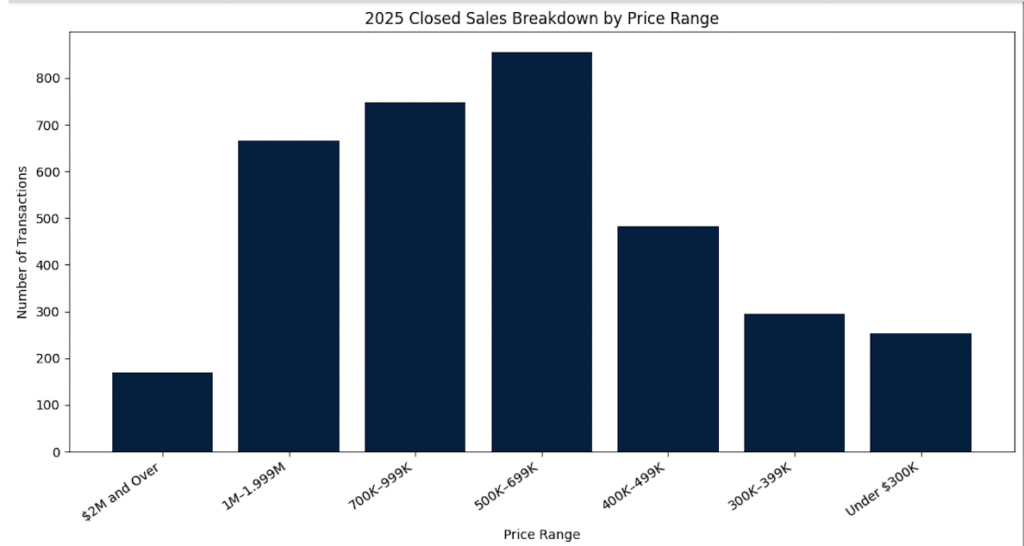

In 2025, homes above $2 million accounted for about 5 percent of closings within the brokerage. Nearly half of all transactions fell between $500,000 and $999,000, with roughly one-fifth between $1 million and $1.999 million.

That middle tier is where the market speaks first and loudest. It is also where conditions show up fastest and without warning:

• Rate movement hits buyer behavior first.

• Sellers quickly learn whether pricing reflects current demand or last year’s optimism.

• Deals tighten or unwind before they can be explained away.

Steve Studley, the CEO of Cascade Hasson Sotheby’s International Realty puts it this way: “If you want to understand the market, watch the middle. That’s where pricing gets tested in real time and where hesitation shows up first.”

⸻

Accuracy Overtook Optimism

There is a long-standing myth in real estate that confidence is the product.

It is not.

In 2025, accuracy was the product. Buyers were cautious. Sellers were protective. Patience for guesswork was thin.

Accuracy is built through repetition, exposure, and constant feedback.

Studley explains: “Adaptability isn’t optional. It’s our edge. The more real time information we share, the faster we make better decisions for our clients.”

That mindset defined 2025. The advisors who succeeded were the most adaptable. At Cascade Hasson advisors are expected to test assumptions, recalibrate quickly, and respond to conditions as they are.

In practice, that meant pressure testing pricing early. Sellers needed realism delivered calmly. Buyers needed someone who could separate signal from noise. The professionals who stood out translated data into decisions.

⸻

The Network Most Consumers Do Not See

Homeowners hire an individual. If they choose well, they gain a network.

In a market that shifted month to month, isolated judgment became expensive. Shared information became an advantage. Advisors were supported by a steady flow of real world intelligence, from market briefings to pricing workshops and negotiation reviews, designed to respond to what is happening now. That collaboration is reinforced by the firm’s in house marketing and operations team and its intranet platform, Propel, built to help advisors work more efficiently and with greater clarity.

Steve Studley explains it this way: “Individual talent is powerful. But shared intelligence is what creates consistency. When our advisors collaborate, clients aren’t getting one opinion. They’re getting the insight of thousands of transactions happening across the region. That’s how we reduce surprises and improve outcomes.”

In 2025, leadership provided steadiness. Expectations were set early, emotions were kept in check, and even difficult calls made sense once outcomes were clear.

The market did not freeze. It filtered. Deals moved when pricing was defensible, expectations aligned, and guidance rose above the noise.

⸻

What This Means for 2026

The defining tension of 2025 was simple. Sellers remembered yesterday’s prices. Buyers priced tomorrow’s risks. The market balanced somewhere in the middle.

It rewarded execution.

That tension does not disappear in 2026. If anything, it sharpens. Buyers are still analytical. They are underwriting with caution, not optimism. Sellers who price ahead of the market instead of behind it will move with more confidence and fewer surprises. The middle tier will remain the proving ground, where sentiment turns into action first and pricing resets show up before headlines catch up.

As Studley put it, “Volatility doesn’t stop strong advisors. Lack of discipline does. The advisors who win in 2026 will be the ones who adapt faster and execute cleaner.”

That is the real takeaway. The market may not get easier, but it will stay responsive to clarity and precision. Advisors who manage expectations early, prepare assets thoroughly, and stay close to buyer feedback will create momentum even when conditions feel uneven.

As always–preparation endures.

Homes For Sale

Real Estate Advisors